Turkey Eyes Pakistan-Saudi Defense Pact

Pact Could Expand Quickly

Reports say Turkey seeks to join Pakistan-Saudi mutual defence pact talks that have moved into an advanced phase, with sources describing an agreement as “very likely.” If Ankara joins, the agreement will change from a two-country deal to a three-country partnership that connects Gulf money, South Asian military strength, and Turkey’s defense industry. Importantly, none of these elements automatically creates an “instant NATO.” However, it can still harden deterrence by tightening political commitments, increasing interoperability, and expanding joint procurement options.

Pakistan-Saudi Defense Pact: What’s Signed?

The core document—described as a “Strategic Mutual Defence Agreement”—was reportedly signed in Riyadh “last September” by Prime Minister Shehbaz Sharif and Crown Prince Mohammed bin Salman. The central clause is straightforward: an attack on either party would be treated as aggression against both. That clause matters less for its legal fine print than for its signal. In regional security, perception often shapes behavior before a shot is fired.

Why Ankara Wants In

From Ankara’s perspective, joining can solve three problems at once. First, it widens Turkey’s strategic depth across South Asia, the Gulf, and parts of Africa—regions where Turkish influence and exports have grown. Second, it strengthens deterrence at a time when many partners question US prioritization and predictability.

Third, it opens a larger, more stable market for Turkish defense programs, ranging from drones to naval platforms. That strategic logic also fits a broader reality: Turkey has pushed into the top tier of arms exporters in recent SIPRI-era reporting, reflecting a maturing domestic industry.

The Capability Triangle

One strategist quoted in coverage framed the prospective division of strengths as follows: Riyadh brings financial clout, Islamabad brings nuclear capability plus ballistic missiles and manpower, and Turkey brings operational experience and a developed defense industry.

That “triangle” is not just a talking point. It shapes what the pact could do in practice:

- Money accelerates readiness: training pipelines, spares, munitions, and basing upgrades.

- Strategic capability changes risk calculations, even without explicit nuclear language.

- Industrial depth increases sustainment and reduces supply-chain fragility.

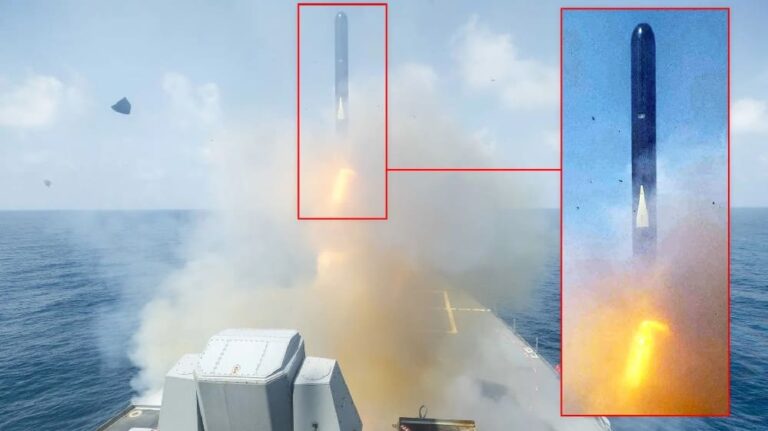

The trilateral idea is not a new concept. Turkey already builds corvette warships for the Pakistan Navy and has worked on upgrades for Pakistan’s F-16 fleet, according to the reporting. Drone cooperation also features heavily, with Turkey described as sharing UAV technology with both countries. On the naval side, the report notes that Saudi and Turkish defence officials held a first-ever naval meeting in Ankara, a small but telling indicator of institutional warming.

Kaan: Programme Leverage

One practical driver is Turkey’s Kaan fifth-generation fighter program. Coverage says Ankara wants Pakistan and Saudi Arabia to join the program. If true, the motivation is obvious. Fifth-gen projects need partners for funding, subsystems, supply chains, and long-term orders. Meanwhile, partners seek influence over requirements, local workshare, and upgrade pathways. In other words, Kaan’s participation would be less about headlines and more about industrial bargaining power.

Why Timing Matters

The reporting indicates that these talks follow a cease-fire that ended a four-day clash between Pakistan and India in May, while also highlighting tensions at the Pakistan–Afghanistan border and inconclusive mediation attempts involving Turkey and Qatar. Separately, SIPRI’s 2019–23 snapshot shows Pakistan’s arms imports rising by 43% versus the prior five-year period, with China supplying 82% of Pakistan’s imports in that window.

That scale of procurement expansion explains why outside partners compete for a slice of Pakistan’s modernization pipeline. The original reporting also cites a claim that Turkey is Pakistan’s second-largest arms supplier at 11% of Pakistan’s arms imports (as attributed to a 2023 SIPRI reference in the article).

Bottom Line: What Changes

If Turkey seeks to join Pakistan-Saudi mutual defense pact discussions to produce a signed framework, the real shift will show up in implementation, not communiqués. Look for practical steps: routine staff talks, more complex combined exercises, shared maintenance and spares planning, and procurement decisions that lock in interoperability.

If you see industrial workshare—local assembly, MRO hubs, and long-term sustainment contracts—the pact becomes durable. Conversely, if the agreement remains merely a symbol of political intent, it may still have some marginal deterrent effect, but it will not fundamentally change the region’s security architecture. In short, a trilateral pact would matter most if it turns money, industry, and military planning into repeatable capability.