Radial Forging Steel | GFM

A Spanish company surreptitiously delivered a crucial forging machine to Russia, enabling Moscow to continue producing artillery despite strict Western sanctions. According to Russian court documents, the operation reveals how Forward Technical Trade SL, a Spanish company, assisted in delivering an Austrian-made radial forging machine to Russia’s AZK Group in 2025.

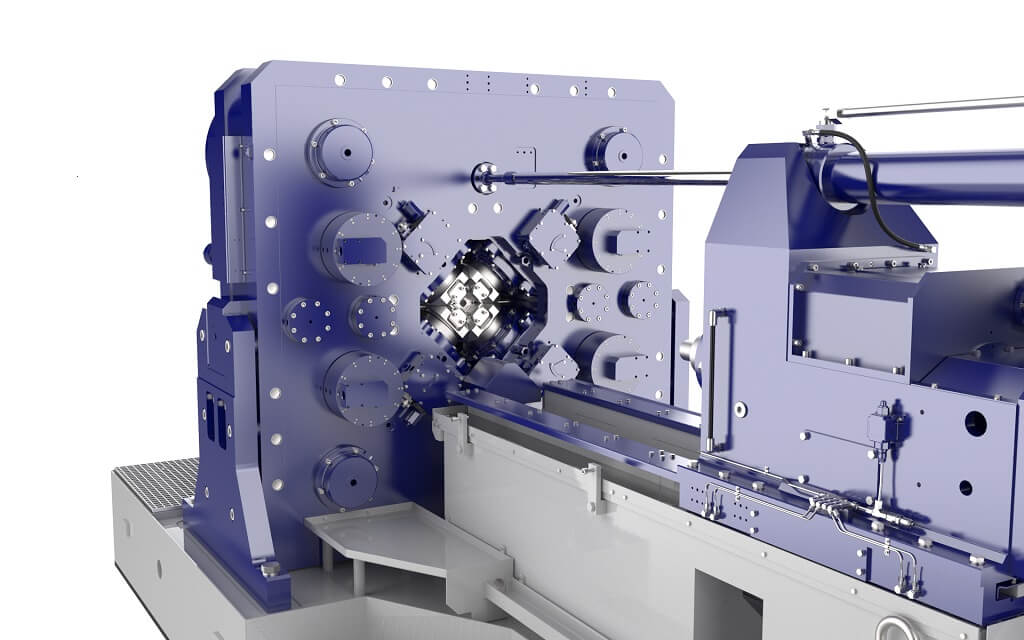

The GFM (Gesellschaft für Fertigungstechnik und Maschinenbau) of Austria produced this 110-tonne machine in 1983, and it is essential for making rifled artillery barrels. The agreement demonstrates how Russia gets around sanctions to maintain its pipeline for military production in the midst of the conflict in Ukraine.

Radial Forging in Russian Artillery Production

The forging machine in question enables radial forging, a precision engineering technique necessary for forming large-caliber barrels. Radial forging, in contrast to traditional techniques, increases barrel strength and accuracy by uniformly compressing and forming metal using multiple hammers. Such equipment is essential for manufacturing parts for systems such as the 203 mm 2S7 Pion and 152 mm 2S19 Msta-S.

High-intensity conflict areas, especially in Ukraine, quickly wear out howitzer barrels, forcing Russia to replace them frequently. Therefore, access to forging machines like the GFM unit directly impacts Russia’s battlefield endurance.

Export Vulnerabilities in the Agreement

The intricacy of the agreement exposes serious flaws in the implementation of export control laws. Albacete, Spain-based Forward Technical Trade SL mediated the sale on behalf of Scorpion’s Holding Group Limited, an intermediary registered in Hong Kong. The seller most likely sourced the machine from second-hand stocks, a sector that European sanctions do not regulate well, despite GFM’s denials of any direct involvement.

Russian customs contested the machine’s classification, exposing its arrival through legal proceedings in Nizhny Novgorod. Stricter controls were implemented after authorities argued that the machine was radial, despite AZK’s claim that it was a rotary forging machine. This court case unintentionally made the full details of the transaction public.

Soviet Legacy, Russia’s Manufacturing Gaps

Due to its incapacity to produce such equipment domestically, Russia continues to rely on foreign radial forging technology. A state-sponsored initiative to create a local equivalent in 2011 was unsuccessful. With at least 26 imported GFM machines since the 1970s, experts like Pavel Luzin of Tufts University attest that Russian artillery production continues to rely on these machines.

As a result, the new purchase aids AZK Group in addressing a serious artillery barrel shortage that is worsened by the 2–3 million shells fired in Ukraine each year. Maintaining accuracy and firepower on systems such as the 2S19 Msta-S and 2A36 Giatsint-B requires replacing worn barrels.

NATO vs Russia: Artillery Logistics

Although the range and performance of Western systems, such as the U.S. M777 howitzer, are comparable, their supply chains are more resilient. Forging and supply capabilities are in-house at BAE Systems and other Western manufacturers.

Russia, on the other hand, is forced to rely on outside equipment, which makes purchases like this GFM unit strategically crucial. Furthermore, NATO and Russian barrels have a limited service life of approximately 2,500 to 3,000 rounds. But since sanctions tightened after 2014 and again after the 2022 invasion of Ukraine, Russia has been unable to quickly replace them.

Weaknesses in Export Controls

This transaction serves as an example of how third parties take advantage of regulatory loopholes. Similar to other EU countries, Spain struggles to monitor second-hand sales and enforce regulations on dual-use technology. The incident raises questions about secondary market oversight, even though Spain has not yet responded.

Similar cases have emerged in the Netherlands and Turkey, where middlemen routed sensitive tools into Russian defense firms. They often used shell companies to hide buyers and mask the true end users. China has also supplied Russian companies with machine tools and microelectronics through layered intermediaries. As a result, enforcement becomes harder, and tracing supply chains takes longer.

Financial Backing for Russian Defence

Russia continues to receive significant defense funding, despite sanctions. The Stockholm International Peace Research Institute estimated Russia’s 2024 military budget at $112 billion, supported by $180 billion in energy revenues.

This financial foundation allowed AZK Group to buy the $1.3 million GFM machine, driven by increased war-related demand revenues. Russia’s “fortress economy” model frequently diverts economic resources toward military production, often at the expense of civilian needs. Despite strong sanctions pressure, this strategic focus enables Russian companies to continue purchasing vital infrastructure.

Sustaining Russia’s Artillery Doctrine

The recently purchased forging machine could change how ground combat unfolds in Ukraine. Ukrainian sources report that Russian forces have damaged or lost over 19,000 artillery systems. To maintain operational capability—crucial to Russia’s attrition-based warfighting strategy—they must replace barrels on surviving systems, such as the Giatsint-B.

Russia uses mass firepower, in contrast to NATO’s emphasis on mobility and accuracy. Maintaining a stock of sturdy, rifled barrels supports this doctrine. Such capability would quickly erode in the absence of forging equipment like GFMs.

One Machine, Global Impact

This illicit transaction highlights how flimsy international export regulations are. In spite of sanctions, Russia obtains essential components by utilizing intricate international supply chains, which include Hong Kong, South Africa, Spain, India, and Austria. Washington and Brussels need to close secondary market loopholes as they push for stricter enforcement. If we don’t finish the job, Russia will be able to maintain its artillery advantage—one barrel at a time.