Saudi Arabia’s UAV Push — Baykar and PAC Localisation

Overview

Saudi Arabia is moving fast towards drone localisation. It is partnering with Baykar in Türkiye and Pakistan’s PAC. There are plans for assembly lines for Baykar drones, according to several Tactical OSINT reports.

A loitering munition, inspired by Kemankeş, is also included in the deal. SAMI is likely to handle manufacturing on the ground. These steps fit neatly with Vision 2030 goals, where Riyadh wants over half of defence spending local by 2030. Local production builds skills, jobs, and strategic autonomy.

Why is localisation necessary, and why is it happening now?

Riyadh seeks resilient supply chains, faster sustainment, and sovereign control over upgrades. Crucially, Vision 2030 mandates localisation and has already raised the local share of defence procurement, according to official and industry reporting. Therefore, Saudi Arabia drone localisation isn’t a branding exercise; it is a national capability goal with budget and policy behind it.

Who brings what to the table?

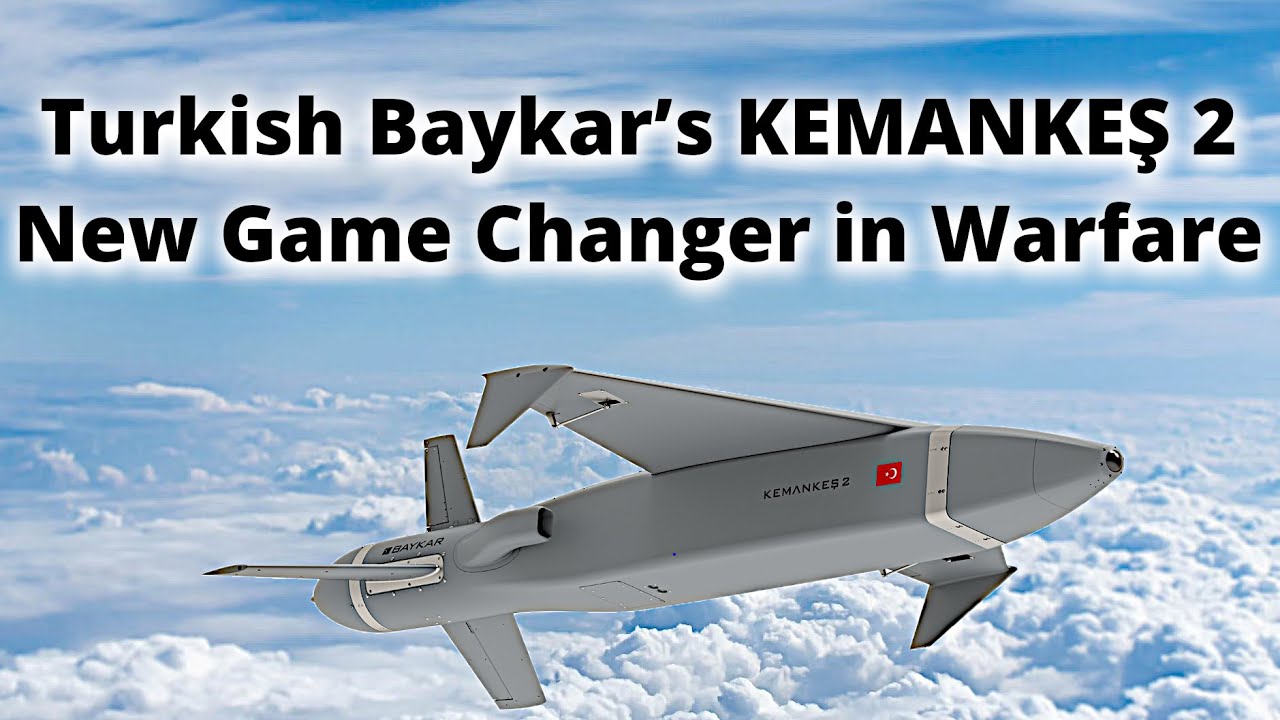

Baykar contributes combat-proven UAS (TB2, Akıncı, and TB3) and a family of miniature, AI-enabled cruise/loitering munitions. The company publicly details Kemankeş 1 and Kemankeş 2, which offer day/night operation, anti-jamming, and 100–150 km-class reach depending on the variant. Such features suit modular production and incremental localisation. Consequently, Baykar is a natural fit for Saudi Arabia’s drone localisation.

PAC brings decades of licensed production, MRO, and avionics integration experience for complex airframes—skills that matter when standing up new lines, qualifying suppliers, and assuring airworthiness.

Its official remit and facilities at Kamra position it to transfer processes and workforce training that Saudi plants can absorb. This experience will likely accelerate Saudi Arabia’s drone localisation practices.

The munition thread: Kemankeş, KaGeM, and “loitering” labels

The tactical report mentions a Kemankeş-derived loitering munition as part of the package. Baykar’s Kemankeş is marketed as a “mini intelligent cruise missile” with AI-assisted guidance and long endurance, blurring lines with loitering munitions.

Moreover, tests indicate expanding roles, including air-to-air interceptions, which underscores its autonomy and seeker maturity. This versatility aligns with Saudi Arabia’s drone localisation ambitions for scalable strikes.

Open sources describe the KaGeM V3 as a miniature air-launched cruise munition. Baykar and Pakistan’s NASTP co-developed it. Analysts often discuss it alongside loitering munitions. Although taxonomy varies, both families deliver stand-off precision from UAS, which is the operational effect Riyadh wants to manufacture at home.

What a phased localisation could look like

- Phase 1: Kit assembly + LRU integration. Start with TB2 or Akıncı kit assembly at a SAMI facility, while integrating line-replaceable units and executing composite sub-work. The process lowers risk yet builds workforce proficiency.

- Phase 2: Munition assembly. Please proceed with the local assembly of Kemankeş-family guidance sections, wings, and fuzes, while initially Validate QA/QC with Baykar and PAC support. This phase cements Saudi Arabia’s drone localisation in critical subsystems.

- Phase 3: Supplier deepening. Localise electronics, seekers, and aeroplane machining as the ecosystem matures. Vision 2030 targets and GAMI policy instruments can incentivise Saudi SMEs to enter the UAS supply chain, thereby boosting sustainability and resilience.

Operational pay-offs

- Persistent ISR and strikes: Indigenous UAS plus local munitions allow high-tempo ISR and precision strikes without import bottlenecks—core to Saudi Arabia’s drone localisation.

- Stand-off survivability: Kemankeş-class weapons enable attacks beyond many SHORAD envelopes, complicating an adversary’s defence planning.

- Attritable mass: Locally produced rounds can be fielded in numbers, imposing cost dilemmas on opponents who must intercept low-cost threats with expensive missiles.

Risks and caveats

First, OSINT Report briefs are paywalled snapshots; workshare, timelines, and exact models may change before formal announcements. Second, “loitering munition” vs. “mini cruise missile” remains a marketing-technical grey zone; nevertheless, Saudi requirements centre on effect, not label.

Finally, localisation success depends on supplier depth, export controls, and sustained program governance—areas that Vision 2030 frameworks aim to address, yet they will require disciplined execution.

References

- https://www.tacticalreport.com/daily/63893-saudi-arabia-advances-local-uas-and-loitering-munition-capabilities-through-strategic-partnership Tactical Report

- https://www.vision2030.gov.sa/media/rc0b5oy1/saudi_vision203.pdf Saudi Vision 2030

- https://baykartech.com/en/uav/kemankes/ baykartech.com

- https://quwa.org/pakistan/munitions/nastp-kagem-v3-loitering-munition/ Quwa