Pakistan's SoluNox Engines Power Brazil’s New Cruise Missiles

SoluNox and Brazil

Reports from Pakistani and Brazilian defense circles indicate that SoluNox engines for Brazilian SIATT cruise missiles will soon enter the heart of a new tri-service strike family. Social media leaks suggest a Karachi-based firm has been selected to supply gas turbine aeroengines for a next-generation cruise missile series intended for the Brazilian Army, Navy, and Air Force.

If confirmed, this deal would mark one of the most significant propulsion exports yet by Pakistan’s private sector. It would also signal that Brazil, already a serious missile designer, now sees value in partnering with non-traditional suppliers to diversify its engine options.

Who are SoluNox and SIATT?

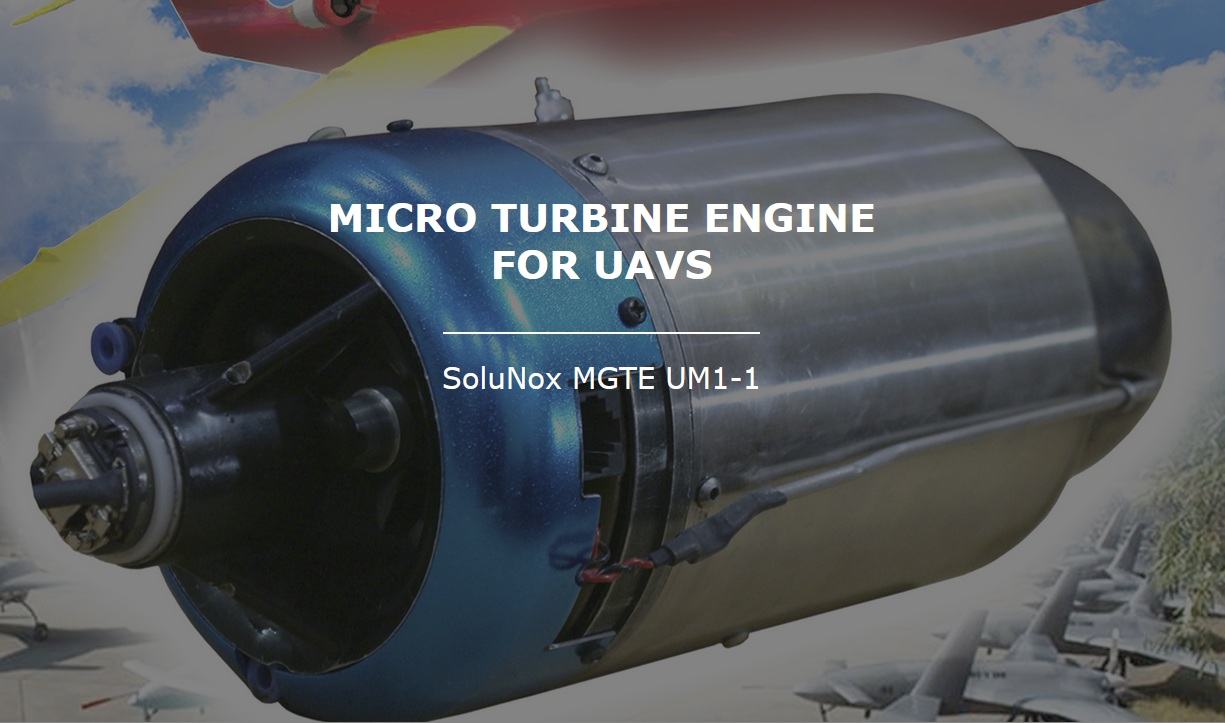

Founded in 2017, SoluNox positions itself as a dual-purpose technology company, concentrating on aerospace, defense, maritime, and energy projects. Its catalogue includes microgas turbine engines, advanced UAVs, and launch systems, all developed with a strong emphasis on 3D simulation, precision machining, and long-term reliability. These engineering foundations position SoluNox engines for Brazilian SIATT cruise missiles as a logical next step, not a radical leap.

On the Brazilian side, SIATT (“Sistemas Integrados de Alto Teor Tecnológico”) is already a central player in the country’s smart-weapons ecosystem. The company co-develops the MANSUP anti-ship missile with the Brazilian Navy and the UAE’s EDGE Group, which now owns a major stake in SIATT. This partnership has yielded a maturing missile line and a growing export profile.

Put simply, SIATT brings guidance, airframe and system integration; SoluNox brings compact, exportable propulsion. Together they shape a genuinely collaborative cruise missile project between developing countries.

Brazil’s expanding cruise-missile family

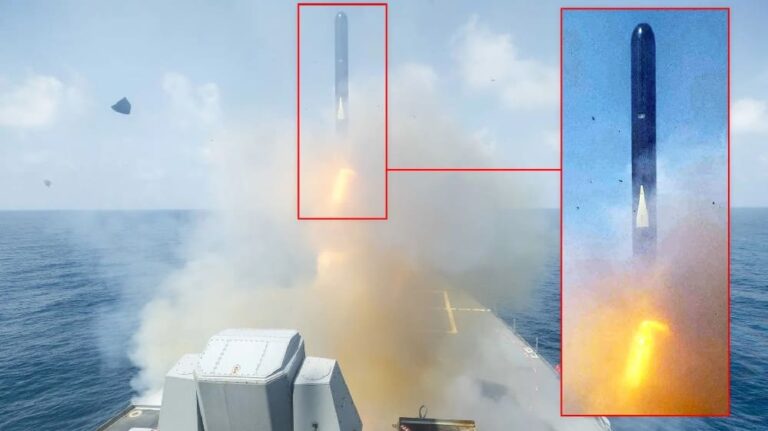

Brazil’s modern missile ambitions focus on turning the MANSUP anti-ship weapon into a broader family. The baseline sea-skimming missile already flies at roughly high-subsonic speed and has evolved into extended-range and land-attack derivatives, with integration work underway on coastal batteries and the Astros II launcher. The Navy’s contract for an initial batch of MANSUP missiles indicates that the program is moving from the test range to the fleet deck.

However, Brazil’s ambitions do not stop at naval warfare. The long-discussed MICLA-BR air-launched cruise missile and land-attack concepts based on the same technology aim to give the Air Force and Army their own precision-strike options. In that context, SoluNox engines for Brazilian SIATT cruise missiles could underpin a scalable tri-service propulsion solution, especially for compact tactical weapons where micro-turbines shine.

Propulsion shift: why bring in SoluNox?

SIATT already cooperates with Turkish and other foreign partners on turbojet engines for the MANSUP extended-range variant. So why look to Pakistan as well?

Firstly, defense planners prefer redundancies. Relying on a single foreign engine supplier exposes programmes to sanctions, export licensing delays, and political mood swings. A parallel line of SoluNox engines for Brazilian SIATT cruise missiles gives Brazil another non-Western, ITAR-light propulsion source.

Second, SoluNox specialises in microgas turbine engines optimised for small UAVs and high-speed drones. That experience is useful for making smaller cruise missiles that need a lot of power, quick speed, and easy upkeep, rather than focusing on efficiency like passenger planes do. For Brazil, the project may be less about replacing existing engines on naval missiles and more about powering new, lighter strike weapons.

Finally, cost and co-development opportunities play a role. A Pakistani partner might accept deeper technology sharing, joint testing in South Asia and more flexible industrial offsets than some established Western engine companies. For spreadsheet warriors in both defense ministries, that combination looks attractive.

Tri-service impact: Army, Navy and Air Force

The Brazilian Navy’s SoluNox engines will power coastal defenses and ship-launched land-attack cruise missiles in the future. Their compact gas turbines allow more missiles per launcher and simpler storage aboard frigates and patrol ships. This matches vessels now preparing to field the MANSUP family of anti-ship and land-attack weapons.

The Army will benefit from road-mobile or Astros-launched cruise missiles using these lighter engines. Reduced engine weight lowers overall missile mass and extends range for the same fuel load. It also makes dispersed launchers easier to support and conceal across Brazil’s vast interior. That mobility becomes a strategic asset during any prolonged or high-tempo campaign.

For the Air Force, air-launched cruise missiles with SoluNox turbines would complement existing standoff weapons for the Gripen E. They could also arm future combat aircraft or unmanned platforms in Brazil’s long-term force structure. A locally controlled missile line fits neatly within Brazil’s wider aerospace and technology sovereignty strategy.

How India Might Respond to Brazil’s SoluNox Deal

New Delhi will likely watch Brazil’s decision to source SoluNox engines from Pakistan with quiet irritation rather than open outrage. Indian planners may publicly downplay the move, yet they privately treat it as another sign of Islamabad’s growing defense footprint in Latin America.

Consequently, India could push harder to market its missile and UAV solutions in the region while also lobbying Brasília for parallel technology projects with Indian firms. Over time, this deal might nudge India to accelerate indigenous engine programmes, ensuring it does not concede propulsion prestige to a rival it still views as a peer competitor.

Implications for Pakistan’s defence industry

From Pakistan’s viewpoint, SoluNox engines for Brazilian SIATT cruise missiles would be more than a one-off export win. They would showcase a private firm delivering critical hardware for a leading Latin American missile programme—moving beyond Pakistan’s traditional state-owned giants.

SoluNox has already promoted its microturbine line as “powering the drones of tomorrow,” highlighting its simulation-driven design, precise machining, and in-house material expertise. A Brazilian cruise missile contract would validate those claims under live-fire conditions, not just trade-show brochures.

Moreover, the deal would strengthen Pakistan’s case as a credible supplier in markets where Indian systems have recently stumbled. Brazil’s decision to turn down India’s Akash surface-to-air missile system, citing capability concerns, shows how performance and digital architecture now trump old political assumptions. Our earlier analysis of Brazil’s SAM procurement choices underlined exactly that shift.

South-South missile networks and strategic risk

This collaboration also fits a wider pattern: South–South defense networks are becoming denser and more technologically sophisticated. Gulf investors are quietly backing Brazil’s growing network of missile design and production houses. Turkish engines already power extended-range variants, while Pakistani-built turbines may soon drive related cruise missile families. Together, these strands form a distributed, non-Western missile ecosystem that steadily chips away at traditional Western dominance.

For Western policymakers, such networks complicate export-control regimes, since no single country provides all the critical components. For operators, however, they offer resilience and bargaining power. If one supplier faces pressure, others can step in, at least in theory.

Of course, challenges remain. Integrating SoluNox engines for Brazilian SIATT cruise missiles will require extensive ground tests, environmental trials, and live firings to validate reliability and guidance compatibility. Brazil’s Navy has already taken years to move MANSUP from first tests to operational qualification; adding new engines will not suddenly make the process effortless. A few more all-night integration sessions for engineers are guaranteed.

Conclusion

In the short term, analysts will watch for official announcements from Brasília and Islamabad. They also expect clarity on which missile variants will actually use SoluNox turbines. Many anticipate hearing the latest news during major defense exhibitions in Latin America. Similar announcements could also emerge from high-profile shows across the Gulf region. Over the medium term, the key signal will be export brochures targeting additional foreign customers.

Observers will closely monitor the inclusion of SoluNox engines for Brazilian SIATT cruise missiles in these marketing materials. If that happens, Pakistan’s propulsion industry will cross an important credibility threshold. Therefore, it will shift from an experimental partner to a recognised supplier in the global cruise missile market.

References

- defensenewstoday.info/brazil-turns-down-indias-akash-sam-citing-accuracy-concerns/

- defensenewstoday.info/colombia-embraces-gripen-e-and-kc-390-to-modernise-air-power/

- navalnews.com/naval-news/2025/07/brazilian-navy-acquires-first-batch-of-mansup-anti-ship-missiles/

- edgegroupuae.com/news/edge-group-and-siatt-announce-deal-brazilian-navy-advanced-mansup-anti-ship-missiles