China Weapons Firms’ Revenue Slump — SIPRI Top 100 Signal

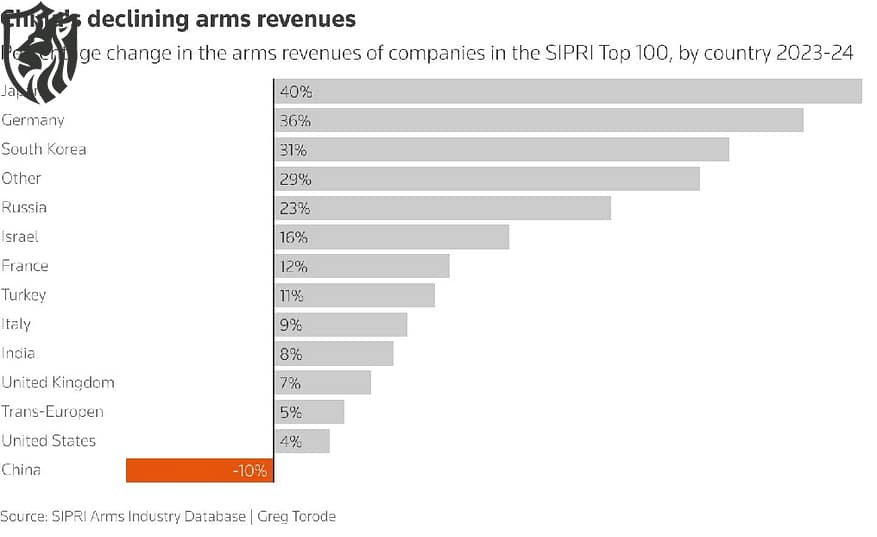

Global demand for missiles, air-defense systems, drones, and munitions surged in 2024. However, one pocket of the industry moved the other way. The China weapons firms’ revenue slump pulled Asia–Oceania into the only regional decline inside SIPRI’s latest Top 100 dataset, even as overall global revenues hit a new high.

The result is not a story about demand disappearing. Instead, it is a story about friction—procurement slowdowns, disrupted contracting cycles, and governance shocks that can hit even huge state-backed defense groups. Moreover, it arrives at a sensitive moment, because regional competitors in Japan and South Korea are scaling exports and production lines fast.

SIPRI Numbers: A Split Outcome

SIPRI estimates the Top 100 arms-producing and military services companies earned $679 billion in 2024, a 5.9% rise and the highest level SIPRI has recorded. Yet Asia and Oceania fell to $130 billion, down 1.2% year over year, making it the only region to shrink.

The decline clearly centers around a single national cluster. The China weapons firms’ revenue slump saw the eight Chinese companies in the Top 100 post a combined 10% fall to $88.3 billion. In other words, a single national cluster dragged the regional line down despite booming global totals.

Why China’s Defence Giants Fell in a Record Year

Several overlapping dynamics can create a downturn for large defense primes, even when war and rearmament drive orders elsewhere. First, a corruption crackdown can slow approval chains. It can also pause programs while auditors recheck contracts, suppliers, and milestones.

Second, uncertainty shifts behavior. Management teams tend to reduce risk when oversight intensifies. Therefore, they may delay subcontracts, slow hiring, and resequence deliveries. Those moves protect compliance, but they can still depress annual revenue recognition.

Third, state procurement can magnify the effect. When a government customer changes their schedules, the prime contractor feels the impact immediately. That matters because many Chinese groups remain heavily exposed to domestic ordering patterns, even when they pitch exports. This phenomenon helps explain why the China weapons firms’ revenue slump looks so sharp against a rising global baseline.

NORINCO Highlights the Drop

SIPRI highlights one major outlier inside the Chinese cohort: NORINCO, China’s key land-systems producer, recorded a 31% fall in arms revenues. That scale suggests more than routine cyclicality. It implies material disruption in contracting tempo, delivery timing, or both.

Japan and South Korea Surge

While China’s aggregated numbers fell, Japan and South Korea moved aggressively in the opposite direction. SIPRI’s reporting and press coverage point to strong year-on-year growth for both countries’ firms, supported by higher production, modernization orders, and expanding export footprints. This matters for the market narrative. Buyers do not only compare specifications.

They also compare delivery credibility, industrial throughput, and political risk. Therefore, the revenue decline of the Chinese weapons firm can become a perception problem as much as a financial one—especially in competitive tenders where schedule certainty decides the winner. If you track Asia-focused procurement and industrial trends, keep your regional context handy via Defense News Today’s Asia desk.

Scandals and Export Risk

Export customers watch scandals differently from domestic audiences. They do not just ask, “Was anyone punished?” They ask, “Will this disrupt delivery, spares, and upgrades?” Moreover, they want to know whether sanctions risk or reputational exposure will follow them home.

A persistent enforcement of compliance can have both positive and negative effects. On the one hand, tighter oversight may reduce leakages and improve long-term efficiency. On the other hand, it can slow near-term execution and complicate pricing. Either way, export teams must compete while the organization absorbs change.

Why It Matters Beyond Rankings

SIPRI’s Top 100 is a revenue lens, not an order book lens. Still, revenue is a hard signal because it reflects what companies actually delivered and recognized in the year. Therefore, we should interpret the revenue slump of China’s weapons firms as a short-term operational and contraction shock within an otherwise expanding global cycle.

That shock lands amid a wider contest for industrial leverage in Asia—chips, materials, propulsion, sensors, and manufacturing capacity. If you want a related perspective on how industrial inputs shape military power, see this internal analysis of China’s leverage in critical materials.

What Defence Planners Should Watch Next

1) Delivery Timelines and Contract Re-Phasing

Watch whether Chinese primes “catch up” via accelerated deliveries in the next reporting cycle, or whether delays persist.

2) Export Campaigns in SE Asia, the Gulf, and Africa

Track whether competitors exploit the moment with bundled financing, faster lead times, and better sustainment offers.

3) Governance Signals That Calm Buyers

Clearer procurement processes and predictable program management can restore confidence faster than marketing can.

4) How Regional Supply Chains Adapt

If domestic programs tighten, companies may lean harder on exports. Conversely, they may prioritize domestic rearmament.

Conclusion

The world’s arms industry grew in 2024, and it grew fast. Yet the China weapons firms’ revenue slump shows that politics, procurement discipline, and internal disruption can still overpower demand in the short run. Meanwhile, Japan and South Korea benefited from the same security climate that lifted global totals, and they look positioned to press their advantage in export campaigns.

If China’s major groups stabilize contracting and restore predictable delivery, the downturn may prove temporary. However, if the causes linger, the region’s competitive balance could shift in ways procurement teams will notice first—on lead times, support packages, and trust.

References

- https://www.sipri.org/media/press-release/2025/sipri-top-100-arms-producers-see-combined-revenues-surge-states-rush-modernize-and-expand-arsenals

- https://www.sipri.org/visualizations/2025/sipri-top-100-arms-producing-and-military-services-companies-world-2024

- https://www.reuters.com/business/aerospace-defense/chinas-military-firms-struggle-corruption-purge-bites-report-says-2025-11-30/

- https://www.scmp.com/news/china/military/article/3334509/chinas-scandal-hit-weapons-firms-drag-down-regional-sales-record-breaking-year